A long-standing question in public policy is to what extent income discourages illicit activity. To be sure, there is a strong negative correlation between income and crime — people with higher incomes are much less likely to be involved in the criminal justice system. But what is that correlation driven by? Indeed, it could be driven by numerous factors other than the income itself — for example, people with higher incomes generally have higher education levels and it could be that education is the true deterrent.

Because the correlation between income and crime could have multiple sources, a more useful policy question is: What is the causal effect of income on crime? How much does directly increasing people’s income — for example, through cash assistance programs — deter illicit behavior? Simple at first blush, this question is actually difficult to tackle because there are often countless other differences between groups of people with higher and lower incomes, so pinning down causation is not easy. Simply comparing recipients and non-recipients of a cash assistance program could very well lead to false conclusions about the effect of income on behavior.

In a new paper, we solve this research challenge using a policy change to the Supplemental Security Income program, commonly known as SSI, in 1996. The SSI program provides cash assistance and Medicaid to low-income children and adults with disabilities. The policy change, part of the 1996 welfare reform law and discussed in more detail below, resulted in one group of young people continuing to receive SSI benefits in adulthood while another, similar group of young people lost their SSI benefits once they became adults. We find that removing young adults’ SSI benefits increases their contact with the justice system, and especially over illicit activity intended to generate income. We estimate that removing a young adult from SSI increases the total number of criminal charges associated with income generation (theft, burglary, robbery, drug distribution, prostitution, and fraud) by 60% over the following two decades. This increase in court charges leads to a 60% increase in the likelihood of being incarcerated in a given year over the same time period.

Effects of Supplemental Security Income on Crime

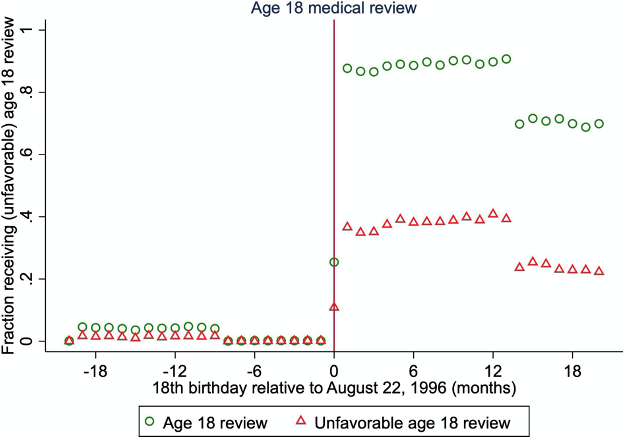

In our study, we use a policy change created by the Personal Responsibility and Work Opportunity Act of 1996, the welfare reform bill passed by a Republican Congress and signed by President Bill Clinton, at a time when prison spending and populations were ballooning. Among its many restrictions on welfare programs, the law included a rule that children receiving SSI benefits for a disability had to be reevaluated for SSI under the stricter adult rules when they turned 18 years old. Under the new rule, any child with an 18th birthday after the law’s enactment — August 22, 1996 — was to be reevaluated as an adult. The two figures below illustrate the natural experiment we exploit. Most children who had an 18th birthday after August 22, 1996, were reevaluated, and many removed from SSI as adults. In contrast, nearly all children with an 18th birthday before this date escaped the reevaluation and were allowed onto the adult program.

This rule thus created an unlucky group of young adults just after the birthdate cutoff who, despite being no different in health or earnings potential than the individuals just before the cutoff, were much more likely to be removed from SSI at the age of 18 years. Since the only difference between the young adults on either side of the cutoff date is the likelihood of receiving a review and being removed from SSI, we can compare the adult outcomes between the people on the two different sides of that (arbitrary) date to measure the effect of being removed from SSI at age 18.

We focus on two main outcomes: formal employment and contact with the criminal justice system. To measure criminal charges and incarceration, we create the first-ever link of data from the Social Security Administration to criminal records using data from the Criminal Justice Administrative Records System.

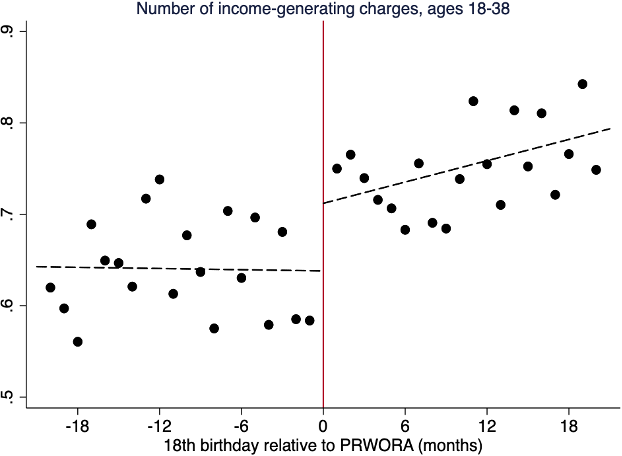

We find that SSI removal at age 18 increases the number of criminal charges by 30%. Figure 2 shows the sharp increase in the number of criminal charges at the cutoff, meaning that those young adults who received a review and were removed from SSI had more criminal charges as a result. Importantly, the increase in charges is concentrated almost entirely in illicit activities that are intended to generate income — theft, burglary, robbery, fraud, drug distribution, and prostitution. For men, the effects are concentrated in theft, burglary, and drug distribution, while for women they are concentrated in theft, fraud (e.g., identity theft), and prostitution. In contrast, there is very little increase in violent crime or other non-income-generating crimes.

Fig. 1: Likelihood of receiving an age 18 medical review and the likelihood of receiving unfavorable age 18 review (i.e., removed from SSI at age 18).

These findings suggest that many of these young adults attempt to replace the SSI income they have lost with income from illegal activity. In fact, over the two decades following SSI removal, the effect of SSI removal on the likelihood of having a criminal charge associated with income generation is about twice as large as the effect of SSI removal on the likelihood of maintaining steady employment. Moreover, the effects on justice involvement are highly persistent: even as the young adults approach the age of 40, the effect of being removed from SSI at age 18 continues to have an effect on the likelihood of facing a criminal charge. Much of the persistence can be explained by the Great Recession, which appears to have amplified the effects of SSI removal.

We also study the effects of SSI removal at age 18 on justice involvement across different demographic groups. In order to qualify for SSI, children who receive SSI must come from households with low income and assets. But even within this group of disadvantaged young people with disabilities, we see disparate effects of SSI removal at age 18 on their contact with the justice system in adulthood. SSI removal increases the likelihood of having an income-generating criminal charge for all observable groups — men and women; two-parent and single-parent households; Black and white; and physical, mental, and intellectual disabilities. However, SSI removal has a disproportionate effect on incarceration for groups with an already-high level of incarceration: men, youth from single-parent households, Black youth, and youth with mental conditions. Thus, SSI removal exacerbates existing inequality in incarceration rates.

The increase in criminal charges resulting from SSI removal has real consequences for both the young adults removed from SSI and for society. For the young adults, the likelihood of incarceration in a given year increases from 5 percent to 8 percent, a 60% increase, as a result of SSI removal. There is substantial evidence that being incarcerated and having a criminal record have adverse consequences on future outcomes. Regarding implications for society, we calculate that the costs of enforcement and incarceration nearly eliminate the savings to the government from lower spending on SSI benefits. Moreover, the cost to the victims of the increased criminal activity is staggering: $85,600 per SSI removal based on our calculations using conservative assumptions.

Implications for welfare policy

What do the effects of removing young adults from SSI tell us about the effects of cash welfare more generally? To be sure, young adults removed from SSI are a specific population: They had disabilities as children and come from poor families. But other factors suggest that the results may be generalizable to programs like the expanded child tax credit, which saw a limited resurgence during the pandemic, or a universal basic income. Like those enacted or proposed programs, SSI provides a sizable cash benefit to low-income households. The population of SSI recipients who are removed from SSI are more similar to the general population than the average SSI recipient. Moreover, we find effects of SSI removal on justice involvement on every observable subgroup. Our results are consistent with other research suggesting that income affects criminal justice involvement.

More generally, the results question the historical focus of welfare policy on the discouragement of work. We show that while SSI does indeed discourage formal employment among young adults, its much larger effect is to discourage criminal activity. For these young adults, maintaining steady employment in the formal labor market may not be feasible, whether or not they receive SSI benefits. There may be insufficient jobs to absorb them into the labor market, or they may have insufficient skills to compete for employment. Other structural disadvantages may hold them back. In the face of these realities, many instead turn to criminal activity to recover the lost income after they are removed from SSI, with staggering consequences for their own lives and for society at large.

Image: Quote Catalog/Flickr