When federal and state policymakers built their child support systems in the 1980s and 1990s to “make men pay,” they made few distinctions among men: They lumped indebted fathers into one category — the deadbeat — irrespective of their circumstances. In the process, support policies made many assumptions about these parents. If they weren’t paying support, it was because they had chosen not to; if they were not in their families’ lives, it was because they were neglectful. While this might have been true of some, the one thing that definitely united these parents was poverty. By the late 2000s, studies were finding that 70 percent of child support debt was owed by parents who made less than $10,000 year — and 40 percent of those families reported no income at all. This was largely because around the time state child support systems were emerging, the United States was undergoing dramatic social changes.

In the 1970s, family structures began changing and economic sectors began shifting. Divorce rates rose, especially among the middle class, and female-headed households became more common across socioeconomic groups. As manufacturing declined and the service sector expanded, the family wage approached extinction, ushering in the era of the two-wage- earner family. The decades that followed saw a series of economic reces- sions, often referred to as “man-cessions” since they hit traditionally male sectors of the economy particularly hard. So at the precise moment the government set out to make men pay, fewer men were able to pay. This was particularly true of disadvantaged, low-income fathers.

Another important development was happening in the United States around this time, one that is seen clearly every Friday in courtrooms across the nation: the social and political project of mass incarceration. The statistics regarding its impact are quite familiar by now: Starting in the 1980s, the imprisonment rate in the United States surged to unprecedented levels. By the late 2000s, more than 2.2 million citizens were in prison or jail and another five million were under correctional supervision. More than 68 million U.S. citizens now live with the mark of a criminal record. And that mark affects not only the formerly incarcerated but also those connected to them. Mass imprisonment coats families with a broad brush: There are nearly as many children with parents in prison as there are prisoners. Put another way, around 10 percent of all children have a parent under correctional supervision, and 3 percent have a parent in prison.

As a result of these changes, the child support system began to reach deep into U.S. prison and jails. Yet the extent of its reach is difficult to document. Child support systems do not keep reliable information on the percentage of their caseloads that are incarcerated, and departments of corrections do not document how many prisoners have child support orders. Parents try not to “come out” in either system. When dealing with child support, they are leery of mentioning their criminal justice histories; when interacting with criminal justice officials, they rarely admit to owing child support. Absent a comprehensive, centralized database connecting these systems, we are left to estimate these numbers, though we can say without hesitation that they are quite high.

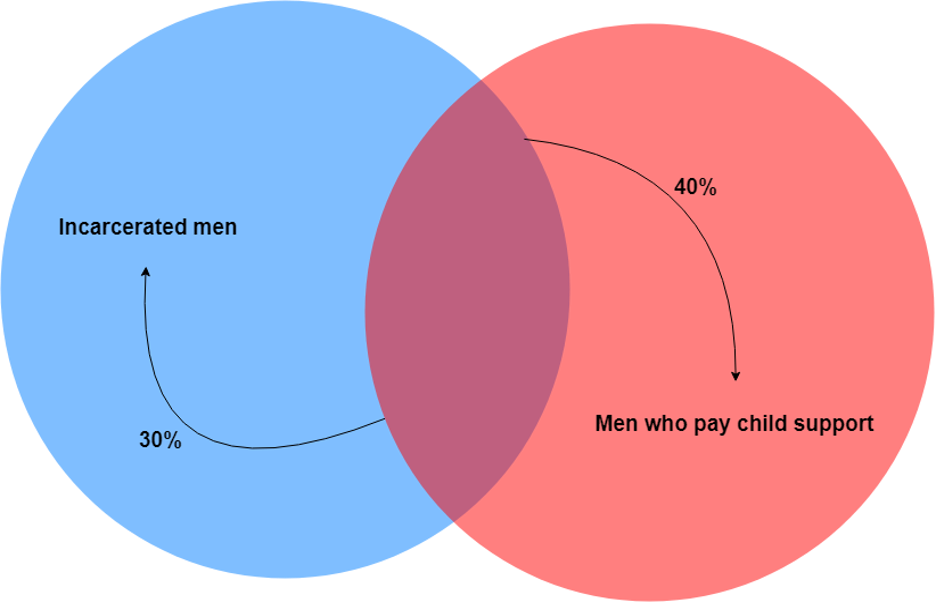

Estimates of the number of parents with criminal records and child support obligations can be computed in two ways, as seen in the figure below. From the criminal justice side, we know that 55 percent of men in state and federal prisons have minor children and that 40 to 50 percent of those prisoners face child support orders. This puts the number of indebted parents currently in prison at somewhere between 450,000 and 550,000. When the same figure for the jail population is added, the number rises by several hundred thousand, bringing it closer to 800,000. When we add to this estimate those indebted fathers who were previously incarcerated, that figure more than doubles. According to national estimates, up to 50 percent of fathers with support orders have some criminal justice background and around 20 percent of nonpaying, indebted fathers were recently incarcerated. Given that there are roughly 5.5 million parents with child support debt, this middle category of indebted parents with criminal justice histories grows to more than 1 million parents when approached from the child support side.

Although the precise numbers may be unclear, one thing is certain: living in the middle area where these systems overlap is both perilous and costly. The policy landscape of child support is fraught for low-income fathers and even more so for incarcerated fathers. Traversing that landscape leads most parents into extreme debt. Here, too, it is hard to know the extent of this debt, since few studies separate the formerly incarcerated from other low-income parents. National-level data are limited; however, state-level studies indicate that incarcerated fathers’ support debt more than doubles during imprisonment, averaging $20,000. Yet as table 1 indicates, the fathers in my sample had a much higher average debt of $36,500. To put this in context, their debt was roughly three times more than the average child support debt of low-income fathers, which is between $10,000 and $12,000. The additional debt for those in my sample was a byproduct of their contact with the criminal justice system. I call this the debt of imprisonment.

| Amount Owed | Number N=125 | Percent |

|---|---|---|

| Less than $5,000 | 15 | 12 |

| $5,000 to $10,000 | 12 | 10 |

| $10,000 to $30,000 | 29 | 23 |

| Over $50,000 | 47 | 38 |

| Don’t Know | 22 | 17 |

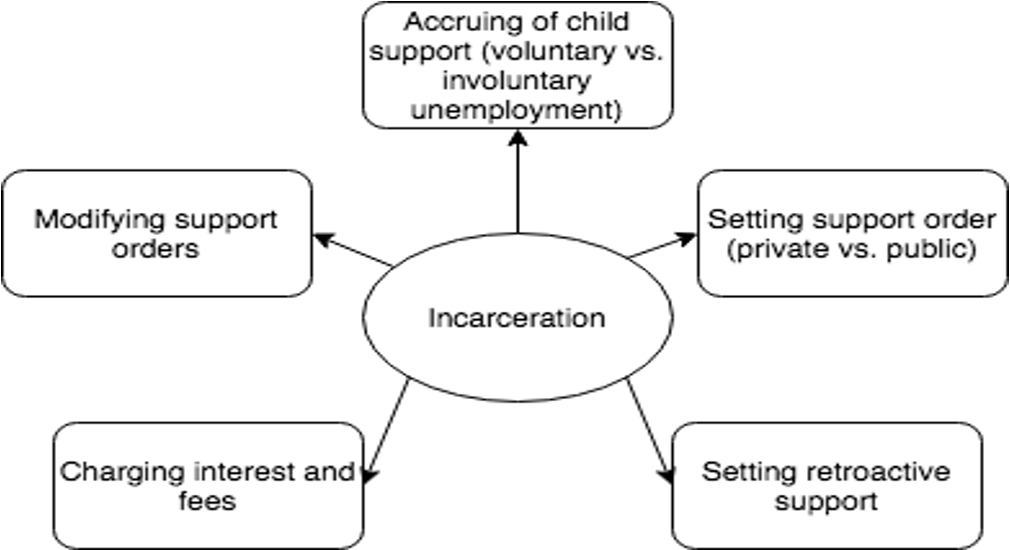

Why does incarceration lead to so much debt? This is a somewhat vexing question since there are few child support policies aimed specifically at the incarcerated. Except for the in/voluntary unemployment clauses and the $0 incarceration support orders, child support provisions do not treat the incarcerated much differently than the non-incarcerated. And this is part of the issue: Despite their profoundly different circumstances, incarcerated parents navigate a set of child support policies similar to those faced by non-incarcerated parents. So to understand how the debt of imprisonment emerges, we need to pull apart these policies and trace their effects on this group of parents. For this, we need to delve into policy implementation and the ways in which actual state practices place incarcerated fathers at a disadvantage as they negotiate the dynamics of parenthood, punishment, and debt.

Social scientists have not spent much time analyzing these dynamics or showing how the physical confinement of imprisonment leads to the financial confinement of child support debt. Instead, most research remains focused on child support and criminal justice as separate entities in terms of their processes and outcomes. We know a lot about the trajectory and consequences of child support policy, from how it emerged as a federal issue in the 1970s, to how enforcement measures expanded in the 1980s, to how the accumulation of debt surged in the 1990s, particularly for the poor. And we know even more about developments in criminal justice, from the economic and political forces propelling mass incarceration, to the specific policies underlying it, to its far-reaching effects on family and community life. Yet we know less about the connections and overlaps between these systems. To the extent that social scientists do examine institutional overlaps, they do so by tracking the “spillover effects” of incarceration — that is, how imprisonment affects work, family, and civic life and weighs down people as they struggle to reintegrate.

Social scientists have not spent much time analyzing these dynamics or showing how the physical confinement of imprisonment leads to the financial confinement of child support debt.

These state systems operate somewhat differently and the ways they are linked have generated complex entanglements for fathers. Instead of spilling over in a linear way from one institution to the other, these entanglements are multidirectional. Instead of piling up in fathers’ lives, they work in circular ways to form feedback loops of disadvantage. Incarcerated fathers get ensnarled at every stage of the child support process, from the setting of their orders to their post-release modification. The figure below provides a visual representation of the processes that comprise the debt of imprisonment:

While child support and criminal justice institutions might insist on their separateness, parents experience their interconnections. Indeed, part of the power of these state systems lies in their denial of those intersections. Each system has its own separate demands and expectations, yet parents living between the two of them encounter these demands as crisscrossing. From setting support orders in absentia to the legal processes of child support court, these systems feed off each other. This makes incarcerated parents’ relationship to child support different from that of other low-income parents. Incarcerated parents are situated across institutions in ways that consistently trip them up: from the perils of code-switching, to the trajectory of the Bradley debtors to the traveling stigma of prison, these parents stumble as they try to manage it all. With each stumble, the debt of imprisonment accumulates to levels unknown by other disadvantaged parents.

The institutional loops connecting child support and criminal justice are not just conceptually important — they also have policy implications for how to address the debt of imprisonment. Given the immense size of this debt, some state officials have begun to think seriously about policy reforms for this group of parents. Perhaps the most common way states have done this is with $0 incarceration orders of the kind California experimented with. Yet as the California experience shows, incarceration orders are hardly a panacea; they often expose larger institutional entanglements. Addressing these entanglements means recognizing the unique context of incarcerated parents and the multiple obstacles they confront. This might mean rethinking the Bradley Amendment, especially for institutionalized parents who are unable to advocate for themselves. It might involve ending public assistance payback for institutionalized parents, thus acknowledging the unique constraints incarceration places on earning income. Or it might mean waiving interest on incarcerated parents’ support debt, also as a recognition that charging interest on a debt that parents have no capacity to repay is excessively punitive.

The institutional loops connecting child support and criminal justice are not just conceptually important — they also have policy implications for how to address the debt of imprisonment.

While these policy reforms might chip away at the amassing of future debt, new policies are also needed for the millions of incarcerated parents who have already accumulated debt. For this, debt forgiveness programs are promising options, particularly for those deep in the red due to incar- ceration and poverty. Even if done only for public arrears, debt relief can make a dent in the debt of imprisonment — since much of the debt owed by incarcerated parents is in fact to the government. Indeed, some states and locales have experimented with such relief, albeit on a small scale, but no program operates across states or at the national level.

This is largely because the politics involved such programs are enormously fraught. On one end are proponents of debt forgiveness, who tend to be sensitive to the precariousness of reentry and to how saddling fathers with so much debt complicates their reintegration. They also argue that easing parents’ debt burden will ultimately benefit poor families and children. Evaluation research backs up both sets of claims: studies show that debt forgiveness leads to better reentry outcomes by reducing debt, enabling employment, reducing stress, and improving familial relationships. In addition, debt relief can be beneficial to the state itself. Fiscal conservatives are often troubled by the large amount of debt owed to state governments and its drain on state budgets. With only 6 percent of all arrears repaid yearly, most of this debt sits unpaid as interest accrues. When it comes to public debt, repayment rates are even lower. For instance, of the $12 billion owed in public debt in California, over 95 percent has been deemed uncollectable. Getting this debt off the books through retroactive forgiveness can thus be in the state’s interest.

More from our decarceral brainstorm

Every week, Inquest aims to bring you insights from people thinking through and working for a world without mass incarceration.

Sign up for our newsletter for the latest.

Newsletter

Yet resistance to debt relief is fierce. Some of it comes from the usual suspects: from “law and order” policymakers, who insist that any sort of debt relief would reward indebted parents for their irresponsible behavior and incarcerated parents for their illegal behavior. These arguments harken back to claims from the 1980s about the need to “make men pay” for their negligence. In fact, some lawmakers rejected the Obama administration’s 2016 final rule updating child-support guidelines by insisting it “gave prisoners a break” from their obligations and incentivized bad behavior. Then there are those who viewed debt relief as an attack on the core principles of welfare reform. Here the echoes are from the 1990s, and claims about the need for public assistance payback. As Senator Orrin Hatch proclaimed in his opposition to the 2016 final rule, child support reform undermined the idea that “single mothers can avoid welfare if fathers comply with child-support orders.”

In this way, despite decades of unmanageable debt accumulation, the political debate continues to be stymied by claims about how reform might reward bad behavior and negligent parents.

It is critical to note that underlying these reform debates are competing ideas about the role of child support. Is child support a form of behavior modification? A way to make men pay for their past mistakes, from nonpayment to criminal behavior? Or is child support a tool to assist families and ensure children get the care they need? Without agreement on these questions, it is difficult to agree on what debt forgiveness implies: What kind of debt is being forgiven? Is it a debt to the custodial parent, the child, or the state? Or is it forgiving a behavior, such as parental irresponsibility or criminality? For decades, child support provisions veered toward behavior modification, which resulted in the massive accumulation of public and private debt. It also resulted in the emergence of an enforcement apparatus that rivals criminal justice in scope and punitiveness — an apparatus that creates its own feedback loops of disadvantage and cycles of debt and punishment.

Excerpted from Prisons of Debt: The Afterlives of Incarcerated Fathers by Lynne Haney, published by the University of California Press. © 2022 by Lynne Haney.

Image: Ruth Enyedi/Unsplash